Telia Lietuva is telco operating in Lithuania, one of the three growing Baltics countries in Eastern Europe (among Estonia and Latvia) and one the fastest growing economies in the euro area.

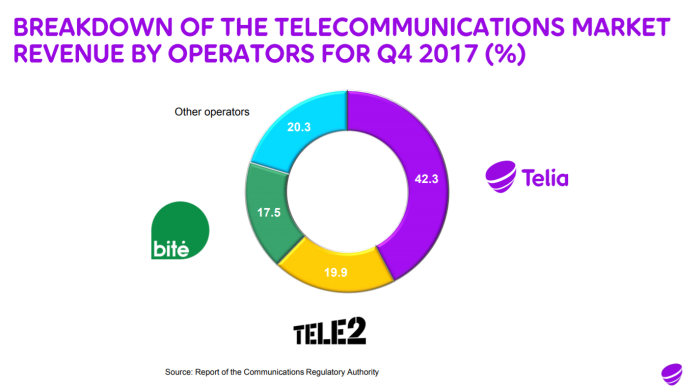

It’s the clear market leader in the overall telco market:

The market is growing approximately with GDP and quite predictably voice is going down and everything else is going up:

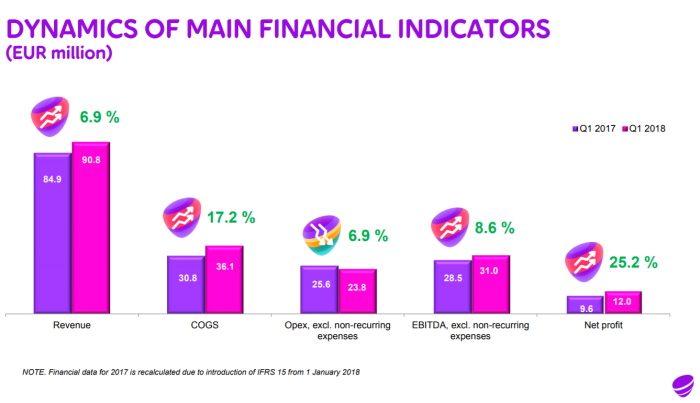

As biggest player, Telia Lietuva is growing nicely with the market:

(The faster than market growth is somewhat an illusion as it includes hardware and IT service revenues, as opposed the market numbers presented earlier, which included only pure telecom numbers)

Essentially, Telia Lietuva is 83 % owned subsidiary of Telia, a Nordic listed mega cap telco, and for some reason listed separately in the Baltic stock exchange.

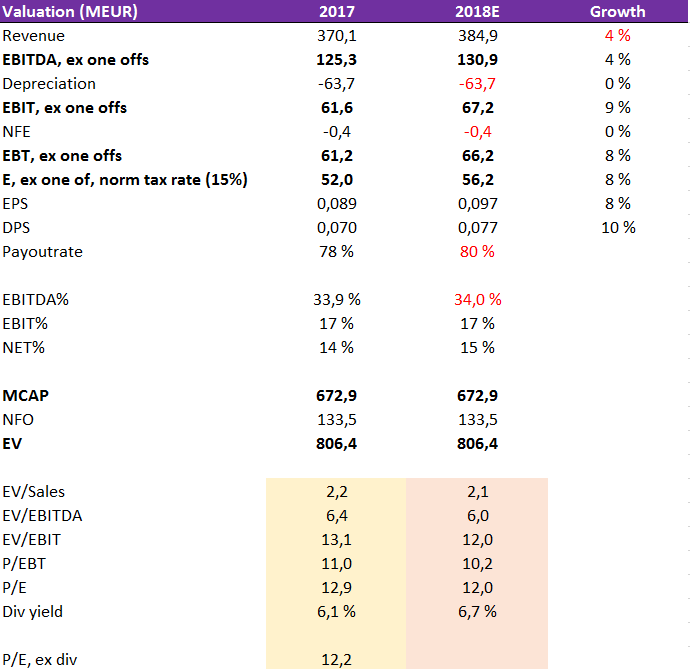

The reason I’m writing about the stock is that the valuation multiples look quite low:

The ex dividend trailing P/E is about 12x and dividend yield is about 6 %.

Trailing EV/EBITDA is 6,4x and, with my extrapolation based forward estimates, forward EV/EBITDA is about 6,0x.

The forward estimate is based on:

1) 4 % revenue growth, down from 7 % last year for no specific reason other than being “conservative” (for comparison, Q1’18 revenue growth was 7%)

2) Same EBITDA margins (Q1’18 EBITDA margin was 34,1 % vs. 33,6 % in Q1’18)

The margins are improving and revenues growing because Telia merged its Lithuanian mobile communication sub (Omnitel) and fixed communication sub (TEO) together about year ago to form Telia Lietuva, which is now reaping cost and revenue synergies (reduced head count and rents, bundled mobile, TV and broadband offering etc.).

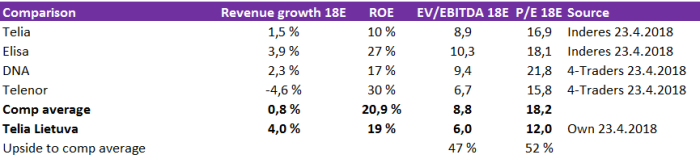

Telia Lietuva is the fastest growing public telco in the Nordics (at least in my sample) with average profitability on capital. Yet, comps are trading at 50 % higher multiples:

The upside investment case is that the multiples converge closer to the peer average.

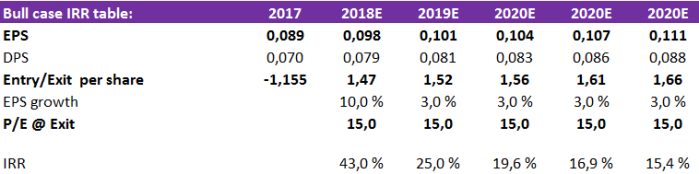

Say, with 15x target P/E, 80 % dividend pay-out rate and 3 % EPS growth (after this year’s pop-up) the IRRs vary between 15-43 %, depending of the time frame between entry and exit:

(Note that the IRR-% is calculated from dividend adjusted purchase price 1,155-0,07=1,085 eur and assumes that the entry is made in end of 2017 and exit between 2018-2020)

The reasonable bear case would be that the growth continues at same pace as the Nordic peers (some 3 %?) and the multiple stays at current level (12x), which with current 6 % dividend yield would imply about 9 % total return, which is not bad for a bear case.

While the Nordic telco multiples don’t seem to reflect it, the bear case for the whole sector is that it’s a value trap:

1) Mobile voice replaces fixed voice

2) Whatsups and Skypes replaces mobile voice, SMS and MMS

3) High speed fibre and cable replace copper

4) IPTV replaces traditional tv

5) Downward pressure in the regulated interconnection and roaming prices (hurts the net originator networks’ earnings)

Indeed there are some problems for Telia Lietuva.

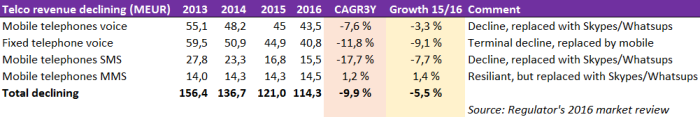

In 2016, the telco revenues in terminal decline declined 6 % and were about 33 % of total revenues:

The trend looks quite bad but declining revenue in one place isn’t problem if it’s offset by increase in other.

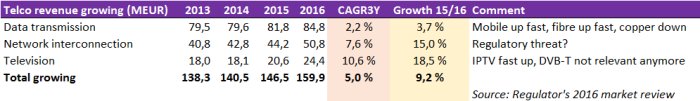

That seems to be the case. Data, IPTV and wholesale businesses are growing:

The telecom revenues that were growing in 2016 were about 50 % of revenues and grew 9 %, faster and from bigger base than the telco revenues that were in terminal decline.

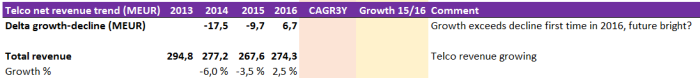

The net is that 2016 was the first year that telecom revenues started to grow again, as the services in terminal decline are gradually getting less important:

While the decline in voice and text is worrying, the growth in data and IPTV make the situation seem like “normal” product mix rotation, not dissimilar to what all consumer products companies are experiencing all the time.

One bigger worry I have had is the Telia Lietuva’s growing interconnection revenue (14 % of total), as it seems to be under regulatory threat.

EU is regulating the prices and putting constant downward pressure on them.

Background is that network interconnection fees are collected

1) by terminating networks for terminating calls from originator network (“call termination fees”),

2) by intermediating network for intermediating calls that neither originates or terminates in the intermediating network (“call transmission fees”)

3) by originating networks for allowing customers that are not customers of the originating network to use their network (“roaming fees”).

As some networks terminate more calls than they originate, some originate more than they terminate, and some terminate as much as they originate, the effect of the tightening interconnection fee regulation would seem to depend of the “net termination position” of the network.

According to revenue figures from the communication regulators reports and COGS from annual report, Telia Lietuva’s network interconnection fee position seems to be neutral:

If my conclusions are correct, it would seem that the price pressure on network interconnection wouldn’t have much effect on Telia Lietuva’s profits, because reduced interconnection revenue would be offset by reduced interconnection costs.

(For example DNA, the Finnish telco in the peer group with highest P/E, reports in its listing prospectus that it’s net payer of interconnection fees, which would indicate that it has more regulatory risk than Telia Lietuva).

Conclusion

There is a lot of debate of future of telcos longer term. What will they do after everybody communicates through Skype and Whatsup?

There are lot of arguments back and forth and I don’t have any real insight on them.

Yes, the voice and text are dying, but data is exploding, connected devices growing exponentially (IoT) and speed becoming increasingly important factor (AR/VR/AI/Robots).

Telcos sees this as an opportunity and analysts as threat and what do I know other than the short-term trend for Telia Lietuva and other Nordic telcos I have watched is up (due to growing broadband revenues as customers change to faster connections).

More over, as the threats are industry wide and my thesis is relative value play, 12x P/E vs. 18x P/E, the argument of long-term industry trend is not particularly important.

For if, due to OTTs and regulators, telcos in general should trade at low multiples, then all of them should, not just one of them, especially the one with seemingly fastest growth, industry average ROE and relatively attractive regulatory position.

For me, Telia Lietuva seems decently valued, decently growing and decently stable business with no immediate threat for catastrophe, which also brings some “low beta” exposure to my portfolio other than cash (I have quite lot of cash and cyclical stocks in my portfolio).

As subsidiary of megacap telco, I don’t see the concentrated ownership as a problem.

The parent Telia has been exiting its Eurasian operations with new strategy to focus on Nordics and Baltics, and who knows if there is a buyout offer coming for the minorities?

(Just for another comp, Elisa, a Nordic telco, bought Baltic telco Starman with 8,4x EBITDA recently (vs. 6x EBITDA valuation for Telia Lietuva currently).

Disclosure: Long Telia Lietuva with ~10 % position.

Hey!

When looking at the dividend payouts per share, then in 2016 it was 0,03€, a year before 0,01€. I would be a bit concerned when evaluating future payments. What are your thoughts?

LikeLike

Yeah, I don’t know for sure but one explanation could be merger with Omnitel and the structure before that. Now they are together and dividend policy to pay most (was it 80 % or so) of FCF as dividends.

I havent been worried of the dividends other than the future level of earnings/FCF.

Short term probably OK but the longer term threat seema real, I don’t really understand the Nordic telco P/Es..

Thx for the comment!

-Backoftheenvelop

LikeLike

[…] Original blog about the thesis can be found here. […]

LikeLike

[…] Telia Lietuva: Growing Baltic Telco (with Discount?) […]

LikeLike