Few recent updates and thoughts on Installux, a high quality French small cap and one of my core holdings that I originally wrote in 2016.

First of all, no news to anybody but the stock has been hammered down with all the other French small caps:

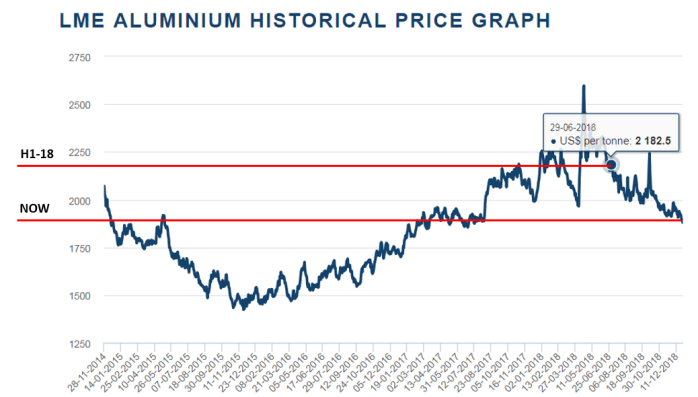

Secondly, aluminum prices are now 1875 USD/ton, down significantly from 2204 USD/ton in the end of H1-18 when Installux last reported its earnings:

Source: https://www.lme.com/en-GB/Metals/Non-ferrous/Aluminium#tabIndex=2

This should have good implications for Installux’s future earnings and thus be constructive for potential rebound in the stock price.

Background is that the management complained about rising costs in H1-2018, when the end-of-quarter aluminum price was the mentioned 2204 USD/ton. Gross margins dropped from 53,9 % year earlier to 51,6 %:

This of course had significant downward effect on earnings and which partly also explains the decline in the stock price.

But now as the aluminum price is hovering around 1875 USD/ton, i.e. back at the same level as in H1-17, one would expect that the gross margins would also go back up to the same levels as in H1-17, all else equal.

Thus my expectation that future earnings will go back up, and more.

For all else is not equal. Last time the management complained about the rising cost, they also raised sales prices by 4 %:

“The increase of our tariffs of about 4% should allow us to envisage a growth identical to 2017, bringing a relative serenity to the new management team for the implementation of its strategy.”

Source: Google translation from French management letter for investors published 14.6.2018.

If my original theory of I switching cost based competitive advantage is true, then Installux should be able to keep the difference between the (expected) decrease in costs due to the decrease in aluminum prices and the increased sales prices as per announced in June 2018. Nice positive “double whammy”.

If we model the gradually improving gross margin back to the 54 % levels seen in H1-17 in next 12 months, the profit growth start to look quite attractive (51% in H2-18E and 23 % in H1-19E):

The other than the gross margin improvement assumptions used in the model were:

- 2,7 % y-o-y revenue growth for H2-18E, same is in H1-18

- No revenue growth for H1-19E

- Unchanged half-yearly OPEX level for comparable half yearly periods

- H1-2018 realized depreciation for H2-18E and H1-19E

On full year basis the next 12 month earnings would grow 31 % relative to those materialized in FY2017:

Current market cap with 310 EUR/share price is 94 MEUR. Net cash in H1-18 was 37 MEUR, so the enterprise goes for 57 MEUR.

That is, 4,9x trailing EBIT and 3,7x my NTME EBIT.

And remember, I only modeled the gross margin improvement to the same level as in H1-17, when the aluminum price was the same as currently. If the sales prices have really been increased by 4 %, then the modeled gross margin improvement should have been even higher than assumed.

Thus the presented forward EBIT multiple might even be a low-ball.

The business is as high quality and stable as they get, so the cycle should not be a worry (if history is any guide, that is):

Also, higher tax rates in France is no more an explanation for lower multiples in France, they will come down from 33 % to “western standard” 28 % in next few years (tax trade for France anyone?).

So I’m long the stock with 12 % position and would like to be very long the stock. Only reason I’m not buying more is self-imposed limit to not do over-sized positions. You don’t want things go horribly wrong with 20 % position, as Wexboy has sometime said.

Last time I was long 12 % (CAFOM), I lost about half of the position so I’m not going to exceed that, at least until I get some success with smaller positions…

In the last financial crisis Installux’s earnings didn’t even budge, which is why I’m not feeling too worried about the cycle’s effect on Installux’s earnings currently.

But the truth is that in the next end of cycle, coming sooner or later, the situation might be different and the low valuation multiple just indicative of that.

Thus also my “cautious” positioning despite the screaming multiples.

Thirdly and lastly, Installux is a traditional French family company. Recently, the founding father stepped down from CEO post and his son stepped in.

Sons want to exceed their father achievements, so the 37 MEUR cash accumulated by his father with excellent business management and skimpy dividends might come handy in the coming years.

Rome had five good emperors in a row in the same dynasty and the future will tell how many Installux will have. Now with the son in charge, I put probability for “bigger moves” and use-cases for the big cash position, probably drag on the stock price, higher than under the father’s leadership.

ps. Installux has invested to its aluminum extrusion plant in Spain, which will 2,5x the production capacity.

With it, Installux will be fully self-sufficient in their aluminum profile production capacity, which will save them say 5%ish extrusion margin in raw material costs. This could be another million increase to earnings H2-19 onward on full year basis.

They are also investigating possibility to rationalize their logistics network for further savings.

My understanding is that they have the aluminum profile inventory in France, painting facility in other facility in France and aluminum extrusion plant in Spain. With my superficial understanding, they all could (and should?) be within the same facility.

I didn’t find the logistics cost for Installux but there could be million or two in cost savings found from there too.

So I’m quite optimistic of Installux’s growth prospects from cost savings perspective.

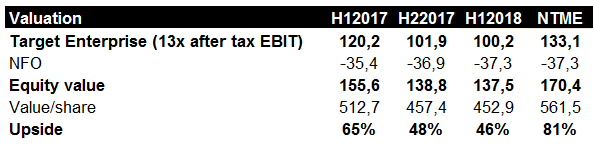

With 13x after tax EBIT I see 46-81 % upside in the stock immediately.

The net cash figure excludes the cash accumulated in H2-18, which could be few million.

Valuation also excludes possibility for profit improvement due to logistics rationalization, increased extrusion capacity, potential market recovery (which has been unexpectedly slow according to management) and “bigger moves” from the new management (but also possibility of significant profit decrease due to the cycle so they are probabably offsetting).

ps2. I “hedge” my bet on the profit improvement somewhat as the management is guiding for lower profits for 2018 than in 2017.

They might have bought the aluminum forward with higher prices and thus the gross margins would improve with the delay, or it might not come at all if the aluminum price goes back up before the new purchases.

It doesn’t matter a lot though, there is a lot of upside with the current profitability/high aluminum price levels also.

Disclosure: Long the stock with 12 % position as of today (from old 6-7%ish)

have you ever looked at Groupe SFPI? I think there are some similarieties.

LikeLike

Yeah I looked at the merger arbitrage with DOM but couldn’t get my head around the transaction due to my bad French and in those cases incomprehensible Google Translations. I haven’t looked at it since.

LikeLike

I think they will start reporting in English from 2018 results on

LikeLiked by 1 person

Thanks for this, I’m going to look deeper myself, might be a good addition to my portfolio. Will come back with some questions :)

LikeLiked by 1 person

Thanks! Remember to also check Valueandopportunities writeups. -Backoftheenvelope

LikeLike

Have you already checked the last half-year report of INSTALLUX? They booked “Actifs liés aux droits d’utilisation” to their balance sheet with an amount of 18.6 Mio. EUR. Do you know the reason?

Does it influence your valuation?

Thanks in advance for your opinion.

LikeLike

Hi it’s capitalized rent if I remember correctly. It only changes the accounting, not the cash flows. It doesn’t effect my valuation.

LikeLike