….continuing from Part 1.

4. Problematic parts that seem well contained

As said in the Part 1, after the Seafood business disposal Apetit has only one problematic part, namely the Food Solutions segment.

But it was also shown that the Food Solutions segment includes the highly profitable Frozen Food business.

Therefore, it must mean that something else than the Frozen Food business is causing the losses for the Food Solution segment.

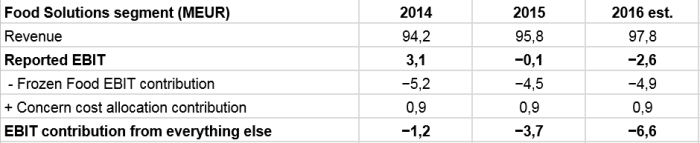

By cleaning out the Frozen Food business EBIT and allocated concern costs from the Food Solutions segment, it can be seen that the “something else” is losing some serious money:

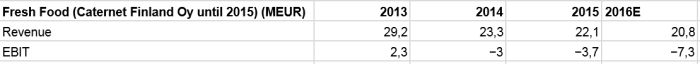

And looking at the Fresh Food business, in all likelihood it has been the main contributor for the losses, although there is only information up to 2015 (in addition to other restructurings the Fresh Food business was merged to Frozen Food business in Q1’16):

So, the Fresh Food business has been deteriorating fast and in 2015 operating loss was -3,7 meur.

As the table shows, in 2016 the losses were probably significantly higher:

Firstly, revenues have declined compared to the 2015 partly because the legacy HORECA business is in difficulties due to weak market and partly because according to the new strategy business focus has been shifted to consumer products in retail channel.

(By clipping and gluing the merged subsidiaries it can be estimated that the revenue decline has been at least 2 meur.)

Secondly, distribution, marketing, product development and other reorganization costs have probably increased because of the shift in business focus and especially because of the new prepared vegetable mix and fresh salad product launches.

(Similarly to the revenues, it can be derived with some accuracy that the Fresh Food segment’s EBIT contribution was about -7 meur but estimate is very rough as during the Fresh Food/Frozen Food merger unknown amount of some other costs were also shifted to the new subsidiary.)

While the business reorganization seems to have caused double whammy of declining revenues and increasing costs, the effect will most likely to be temporary.

The mentioned new products are targeted for consumers and management has very high expectations for them. They play a key role in achieving Apetit’s new ambitious 20%/~20 meur revenue growth target for the Food Solutions segment by 2018.

To get indication of the opportunity, competitor (and potential acquisition target) Fresh Servant Oy AB, that services the same HORECA customers and makes the same salads and vegetable mixes for consumers as the Fresh Food business, has about 42,8 meur revenues and 3,2 meur EBIT (7,5% margin).

With the same margins and the 40 meur target revenue (20 meur existing revenues + the ~20 meur growth target), the Fresh Food’s EBIT could be about 3 meur. Add that to the Frozen Food’s 4 meur concern cost adjusted EBIT and the Food Solution segment’s EBIT could be 7 meur in the future (vs. the current -2,5 meur and vs. the management’s 5 meur vision by 2018).

More over, management’s policy to not tolerate unprofitable businesses and rationalizations made in the Seafood business before disposing it indicate that the management is willing and capable of cutting cost and getting rid of businesses that are not working out.

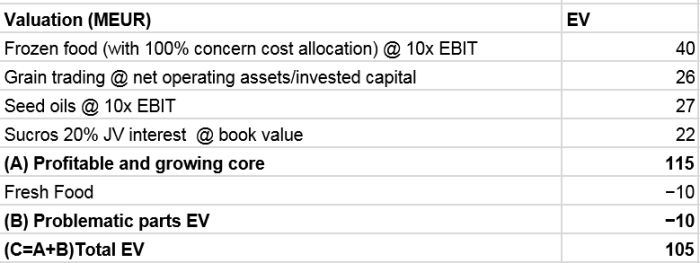

Therefore my conclusions is that the Fresh Food business losses should be interpreted as temporary and thus not capitalized in valuation (by say taking historical average earnings and multiplying them by x).

But to account for the likely future losses from the Fresh Food business somehow, I haircut my original valuation by arbitrary 10 meur (say 5 meur annual losses for two years).

The negative valuation for the Fresh Food business is slightly unfair because for sure the management is incurring the temporary losses because they think that the NPV of future profits will greatly exceeds the accumulated losses and investments.

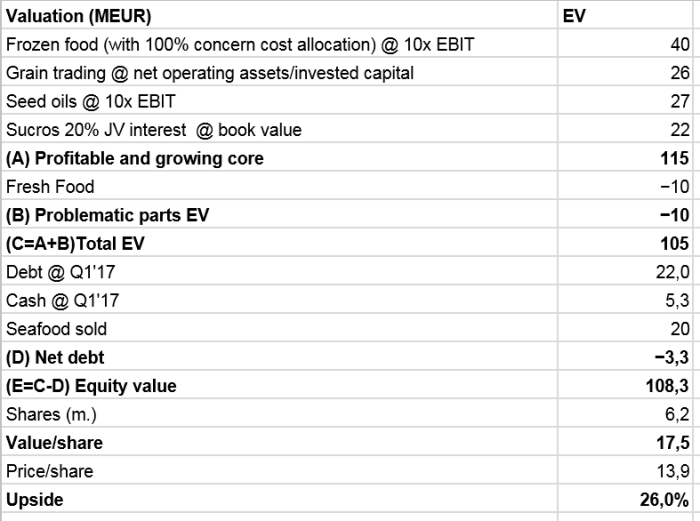

After taking into account the net debt and proceeds from the Seafood business equity valuation looks as follows:

Compared to the current 86 meur market cap the baseline upside is about 26%.

Add in the 5% dividend yield, potential catalyst from the management actions to fix the problematic business units by 2018 and significant discount to book value, the short-term risk/reward profile looks pretty reasonable to me.

5. Excess liquidity for acquisitions as result of the divestments

The previous valuation was based more or less on current facts and situation.

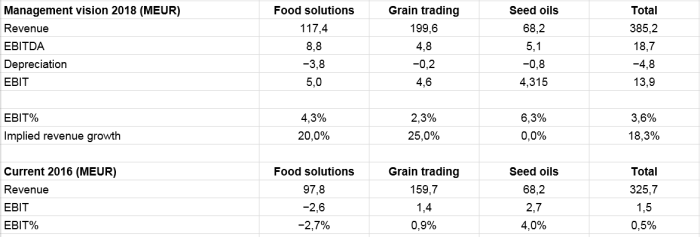

But as mentioned many times, the management has ambitious growth and profitability targets for 2018:

The stated vision is to grow revenues in the Food Solutions segment by 20% mainly through the new product launches and in the Grain Trading by 25% mainly through Baltic expansion.

There are also new profitability targets for each segment.

For the Food Solutions segment profitability targets seems realistic as the Frozen Food business is already exceeding the whole segments target margins and peer companies in the problematic Fresh Food business indicate that it can be very profitable business.

As for the revenue growth target, early signs are good and the vegetable based food trend surely offers nice tail wind.

On the face of it, the Grain Trading and Oil Seed Products segments’ goals seems achievable too.

By increasing consumer products’ share in the Oil Seed Products business revenue mix the profitability “should” increase and by expanding Graind Trading capacity in Baltic by 25% the revenues (and margins) “should” grow.

But rather than try to guess what will happen I have tried to get grasp how achieving the goals would affect the valuation.

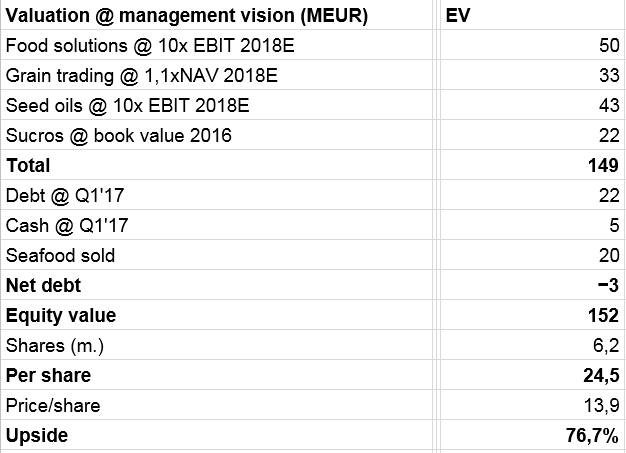

Using management’s vision numbers and same valuation multiples as in my original valuation, except for the Grain Trading business where I use 1,1xNAV instead of 1,0xNAV to reflect the management’s envisioned 14% ROIC, the share would be worth 24,5 eur/share. That’s 77% more than the current share price.

More over, if achieving the goal would take 1-3 years the 0,7 eur/share annual dividend wouls add up to 2,1/share.

Together the “best case” exit value 24,5 eur/share and the 2,1 eur/share cumulative dividends would bring the potential pay off to 26,6 eur/share and upside from the current 13,9 eur/share market price to 90%+.

Because of the new management’s clear strategy and past actions following the strategy (new products, cost rationalizations and non-core business divestments), achieving the envisioned goals seems like being decently probable outcome.

More over, after the Seafood business disposal Apetit will have approximately 20 meur excess liquidity to do growth acquisitions.

The cash could be coupled up with say 45 meur financial debt to stay at management’s target of 40% equity ratio (actual leverage potential to stay within the self imposed 40% equity ratio depends of the target companies’ balance sheets).

The 65 meur potential purchasing power would buy some serious value enhancing earnings if done in the fragmented SME market where valuation multiples are very low compared to public markets.

To get some indication of the opportunity, if the 65 meur purchasing power would be used to buy private businesses with say 8x earnings multiple, the hidden earnings potential behind Apetit’s over capitalized balance sheet is 8 meur.

That’s almost 60% increase relative to the envisioned 14 meur EBIT for 2018. Value effect would be even higher if the incremental earnings would be valued with say 10-15x earnings.

Conclusion

From decent return perspective the question is whether Apetit is worth a book value.

With all of the core businesses being profitable, growing and leaders in their industries the answer is resounding yes. More realistically, they are probably worth significantly more.

But currently the profitable core is hidden under the Fresh Food business losses. As Fresh Food business is at heart of the management’s growth strategy I’m not too worried that the losses would continue for very long.

If the book value or my base line sum of parts value, which are almost the same, is reached the base line upside is 26% +5% from dividends.

With the new management as a catalyst the short term expected return look reasonable.

But the real icing on the cake is if the management vision will be realized and if the excess liquidity provided by the Seafood business disposal is utilized in earnings and value enhancing acquisitions. For if both of them happens the potential return easily exceeds 100%. More over, given the time frame we are speaking here, it could happen within few years (for example the management vision is for 2018).

With high subjective probability for making reasonable return in the base scenario and decent probability of making high return in the management vision/acquisition option scenario the outcome distribution seems attractive for me. This coupled with margin of safety from profitable core businesses, dividend commitment and sub-book value market price.

(Part 1 of the post can be found from here).

Disclosure: Long Apetit with 7% position

[…] This post got a bit long so I decided to divide it to two parts. Part 2 can be found here. […]

LikeLike

Appreciate the longer post, great work. A few follow-up questions after digging in:

– Where did you find the revenue and profit figures for Frozen foods for 2015/2016? I believe the segments changed after 2014, and those figures are no longer disclosed in the ARs?

– And same question on the financials for Caternet (i.e. Fresh foods)? I don’t see revenue/profit split out in the financial reports. And this leads to how you backed into the -7m contribution from Fresh foods in FY16?

– Great data on Fresh Servant Oy Ab – it’s a private company though right? Where are you sourcing its financial data (revenues, profitability, etc)?

– Can you explain your 0.9m in “concern costs” allocated to Frozen Foods? Is this central/corporate costs, and if so how are you estimating this? I believe the central costs are now allocated equally between the 4 segments, but I was guessing 3-4m in corporate costs (based on 2012-2014 #s) overall. Selling off the seafood division would therefore make the rest less slightly profitable.

– Seafood sale – you are estimating 20m because BV is ~21m and they are taking a 1m write-down on sale? They are retaining a minority stake (maybe 15%), so maybe cash proceeds are less than that?

And curious, are you based in Finland? Some of the news articles and details were very helpful but hard for me to source in English..

LikeLike

Basically all the figures are from the individual subsidiaries annual reports. Apetit doesn’t provide them but the data is public and accesible through register officials or through data providers.

The public register authority: https://www.prh.fi/en/index.html , I used credit card to purchase some so should work for non-Finnish citizens too

Example of free data provider(limited data freely): https://www.asiakastieto.fi/yritykset/fi/yritys/20770467/taloustiedot

I also have access to full professional data providers from work which uses those data bases as their source (not quite Bloomberg but almost)

1) The Frozen Food (old Apetit Ruoka Oy) data is available up to 2015 and Q1’16, when it was merged to Caternet Finland Oy (which then changed name to Apetit Ruoka Oy).

The Frozen Food revenue for 2016 can be derived by knowing the 2015 revenues from the individual subsidiary annual report (from the register authorities or data providers) and management commented in some presentation material (Q416 presentation if I remember correctly) that the Frozen Food business grew by 5% in 2016.

The profitability is estimated by using the same 10% profitability as in the Q1’16 last available accounts for the Frozen Food sub (the old Apetit Ruoka Oy).

The profitability estimate for 2016 is supported by managements verbal commentary that the Frozen Foods business has been good all the time.

2) The Fresh Foods data is also from individual subsidiary accounts (register authorities/data providers).

The 2016 data is estimated as follows: Take sum of the old Apetit Ruoka Oy (Frozen Food) 2016 accounts (up to Q1’16) and the New Apetit Ruoka Oy 2016 accounts (which from Q1’16 onwards, after the merger, includes the old Caternet Finland Oy/Fresh Food and the old Apetit Ruoka Oy/Frozen food combined data) to arrive at the combined Frozen Food and Fresh Food numbers for 2016.

Then, as the Frozen Food revenues are known, by backing out them from the combined number for Frozen Food/Fresh Food, we are left with the Fresh Food numbers.

The number is not fully accurate as some costs/revenues from at least one supporting subs (Apetit Suomi Oy) were moved to the new combined unit during the Frozen Food/Fresh Food merger, but probably close enough as, for me at least, the point of the exercise was to identify where and what approximate scale the Food Solution segment’s problem is(although from management’s verbal commentary over the years it’s also clear that the Food Solution segment’s, or its predecessors, problem has always been the Fresh Foods/Caternet Finland business.

3) Yes it’s private co, data accesible from public registers or data providers or their website for at least some info

4) Concer cost is the parent company’s, in the official reports, cost divided by four (equally to all segments).

You are correct about the implied concern cost increase for the rest of the segments as result of the divestment, which I missed. With the 0,9 meur cost allocation and 10x EBIT multiple, I haircut my baseline sum of parts valuation by 9 meur, which reduces the base upside actually quite significantly but I don’t think it kills the investment case (true upside comes from the successful turnaround).

5) Strictly speaking yes, but the 15% stake is in the (problematic, never profitable) Finnish Seafood sub, not in the (profitable) Norweigian/Swedish subs. So my guess is that the 15% stake is pretty meaningless.

6) Yes I’m from Finland and I understand the language issue. I decided to give the links despite language barriers to show the sources where my thinking comes from, especially for the Finnish readers who are probably in best position to challenge my case. If you need clarifications or have questions about the links/sources I’m more than happy to help with translations and further information.

Thx for the excellent questions and comments

-Backoftheenvelope

LikeLike

Thanks for explanation, figured you were pulling sub financials from corporate register but wanted to make sure. Purchased a few as well, but format doesn’t make translation easy.

Do you think the Apetit Suomi Oy revenue of 2m is included in the Food Solutions segment for 2016? https://www.asiakastieto.fi/yritykset/FI/apetit-suomi-oy/20770432/taloustiedot Or would it be technically charged as an expense to the segment before it was merged with the subsidiary after Q1? Since it provides marketing services? If an expense, that would make the Fresh Foods loss a more reasonable 4-5m

Do you have a sense of what the company provides with its “Service” sales in the Food Solutions segment? For example, ff we assume 49m for Frozen Foods and ~20m for Fresh, that still leaves ~27m of Other sales (presumably this Service portion) to reach the segment revenue total of 96.9m. But does this contribute any segment EBIT? Is it expected to grow?

Btw, on another topic – Ferronordic has increased quite a bit in recent weeks – would you still be a buyer / initiate a position at these prices?

LikeLike

Hi, first of all, sorry for the delayd answer. I was on vacation with my grand parents and then was working for few days so the blog thingy was on the sidelines for a while.

a) Apetit Suomi

About the Apetit Suomi, according my understanding it’s some kind of “environmental services” (=water cleaning) company for the industrial area where the Frozen Food business is operating.

So the Apetit Suomi Oy’s revenues are probably some internal transactions with the (old and new) Apetit Ruoka Oy relating to the Frozen Food business.

There might also be some external customers for example somebody utilizing the same water cleaning equipment or something.

Historically Apetit Suomi has had quite a bit of revenues and costs (5,7 and 5,5 meur respectively, in 2015 for example) so following how the costs and revenues should be allocated in the segment is quite difficult to get the concern result out of it.

But the important point is that it has been profitable almost all the time so it hasn’t contributed to the losses for the Food Solutions segment (you can sum the individual subsidiaries’ EBIT lines to get the concern EBIT out, but you cannot sum the individual subsidiaries’ revenues and costs to get the concern revenues and costs out, because of the unknown internal transactions).

(And note, assuming that the Apetit Suomi is some kind of internal services company ONLY for the Frozen Food business, then the old Apetit Ruoka Oy’s and Apetit Suomi Oy’s EBIT’s should be summed together to get out the true profitability of the Frozen Food business. And as the Apetit Suomi Oy has almost always been profitable, it would mean that the Frozen Food business has been even more profitable that I’m suggesting in the blog post).

From the link you provided about Apetit Suomi, you can see that the revenues and costs and EBIT dropped quite severely in 2016. I don’t know, but it might be that the revenues and cost belonging to the new Apetit Ruoka Oy was moved away and what was left are only external transactions. But I’m just speculating and there are some other potential explanations too.

I’m not quite following you with the 2 meur argument?

Apetit Suomi is reported under the Food Solutions segment, yes, it can be found from the annual report notes.

But whether the 2 meur is reported in the Food Solution segment’s revenues is immaterial for explaining the EBIT contribution of the different business. It’s the EBIT line that matters.

But as the Apetit Suomi Oy’s EBIT was 0, it has not contributed to the Food Solutions segment EBIT in any way –> the losses had to come from “somewhere else” (as shown in the post).

b) Service desk business

The service business is food service desks in big grocery stores. They sell fish and salads direct to customers in the retailers premises. Something like this: http://www.esaimaa.fi/f/c/cf/big_Etsa_13154063.jpg

So basically it’s like food kiosk within retail stores. Nobody really knows its profitability. It’s very simple business and thus probably very low margin (retailing sliced and diced fish and salads with personal service cannot be very profitable).

If my Fresh Foods profit business estimate is correct, one can derive that the segment profit is about 0,4 meur. With the 25 meur or so revenues (as you point out and is reported in the CMD deck) the margin would be about 1,6% which makes sense to me.

Service desk EBIT contribution derivation for 2016 (meur):

Frozen Food, 2016E 4,9

Fresh Food, 2016E −7,3

Apetit Suomi Oy, reported 0

Kiinteistöosakeyhtiö Kivikonlaita (some real estate co), reported 0,3

Concern cost, estimate −0,9

Food solutions estimate, before Service desk −3,0

Food solutions, as reported −2,6

–> Service desk contribution, estimate −0,4

The low profitablity result is supported by the fact that the management has not indicated any big problems or successes in the business, unlike in the others (frozen business success and the fresh food business failure has been talked openly).

It’s also quite simple business (one service person selling inventory from desk) so it’s difficult to think how it could be severly loss making (like many millions, or even million)

During the strategic review the Company decided to keep the Service desk business, as it decided to keep the Fresh Food business, despite seemingly and historically bad businesses.

They had excellent change to dispose them, they were new managers without emotional ties to legacy businesses and were probably given very free hands to do what they see best, yet they decided to keep them.

One explanation is that they are “idiots”. The other is that they see something in them.

They have been open about what they see in the Fresh Food business but it’s a bit unclear to me what they are doing with the Service desks business. My best guess is that actually, they are interrelated.

Internationally and in Finland, the trend is that grocery stores are increasing shelf space for fresh foods and for food and salad bars. Idea is to offer some kind of mix where you buy food for home but eat there at the same time.

And there you have it, the Fresh Food business can offer the fresh foods and the Service Desks can do some kind of restaurant/salad bar business. At least that’s my guess and future will tell.

The one competitor/potential acquisition target I mentioned is doing something similar as it already has self service salad bars in grocery stores. And it seems very profitable.

The Service desk business also has started some digital R&D service project for which it gets government R&D support, but the managemen has not told what the project is all about.

So clearly they had opportunity to dispose all these seemingly bad business but yet they have decided to keep them. The fresh food has developed completely new products and there is something going on with the Service Desks.

Thus I think the losses in the food solutions segment are temporary.

d) Ferronordic

I have sold my position from the 19% last time mentioned to 13%, as of few days ago. Reaso is risk management.

I have commitment to stick with reasonable sized positions which I slipped during last purchase from the 10% or so to the 19%.

I was just so happy that my investment case, that’s 2-3 year old, started finally to play out and felt that I had to do something. So emotional reaction from evidence that my analysis is correct.

Now I backed that decision because it was not within my portfolio rules. Nice quick profit though for the additional investment (what 6-7% in month or two).

I will probably sell the position down to 10% soon.

But I think the upside is still pretty good especially because of the catalyst of something happening soon.

And if you study the construction equipment dealer business it’s actually quite good (razor and blade business, high roe, not stable but surprisingly stable, and I have found very few CE dealers in Finland, Sweden, Norway, Denamark that have ever made losses in harch environments, one case in point being Ferro itself which did record profits in real mayhem), and Ferro has quite a few growth leverages to pull, so I’m thinking longer term hold here.

Strugling with the position sizing though :).

Thanks for the excellent questions again!

-Backoftheenvelope

LikeLike

Any takeaways from the Q2 report? Seemed rather average in a seasonally slow quarter, still facing tough ag markets and working on key initiatives but not much showing up in the financials (yet). Trying to setup a call with mgmt – if I’m successful, and major questions you’d ask?

LikeLike

I didn’t find much evidence against my thesis and some evidence that supports my thesis.

The Food Solutions segment is growing and improving profitability significantly. The Frozen Food business is profitable and growing. The Fresh Food business is growing. For reminder, my thesis is that the Food Solutions segment losses are temporary, so things are going to right direction.

I would ask why they are not reporting the Frozen Food business separately so shareholders would clearly know that there is Uper profitable core underneath? Is it really not as profitable as the subsidiary’s official accounts would indicate or is there just communication error? I would ask is the biggest problem part in the Fresh Food business and if so, what is the scale of the problem? I would ask of future of the sugar business and risk related to the raw material suplly in seed oil business (EU has banned some chemicals which would prevent growing the relevant crops in Finland or something)? I would like more information of the Fresh Food/Service desk business, are they going to the salad bar business and why did they want to keep the service desk business as it is so low margin/low value add? Things like that, long term strategy issues. For example do they have plans for manufacturing pea protein, which is hot industry and they have the raw material supply? What’s the meaning of the juice business strategy in the CMD deck, do they have plan for it or are was it just “brainstorming”? Etc. Mainly long term strategy issues and making sure that my thesis is correct that the Frozen Food is super profitable and the Fresh Food is the problem and then long term strategy issues.

The other business are inherently variable so I didn’t find much signal in them.

Overall Q2 was slight dissapointment as foor speed of progress but still progress so I’m still holding my shares.

LikeLike

Thought I’d continue our convo :) Since you are the only one I know following the company closely, would be curious to get your thoughts..

2017 numbers were lacking. Only bright spot I could see was that the losses improved in food solutions, which hopefully means Fresh losses have moderated – it remains frustrating that management doesn’t provide any guidance in splitting this out btw.

But nearly everything else went the wrong way:

– Seafood sale (13.7m cash proceeds) WELL below what I was forecasting. Unclear why they retain a minority stake?

– Oilseed – profits have halved in the last 4 years on flat sales and despite a rising % from packaged/special revenue

– Grain – worst year in a long time

But biggest factor is the revised LT plan. 2018 was supposed to be 20m+ in EBITDA @ 10%+ ROCE. Now 2020 (!!) is only 13.5m in EBITDA at 8%+ ROCE. Even if you assign 1-3m in EBITDA for a hopeful turnaround in seafood that should be backed out of original targets, that’s still a massive cut in mgmt’s plans, a much lower return profile, and 2 years of pushing back the “turnaround”

That combined with the turnover in the exec ranks (IR, CFO) seems to be a giant hit to mgmt’s credibility. Are they just stuck in really bad businesses? Any news or more in-depth reporting on this at the local level?

LikeLike

I surely was disappointed of management moving the goal post and lack of transparency in the food solutions segment. But my overall assessment didn’t come quite as negative as yours, actually, quite the opposite.

First of all, as the CEO says, all the mega trends are behind Apetit, namely the healthy living and sustainability trends. More precisely for Apetit, vegetable based food and vegetable based proteins.

This is the hottest segment in retail, and it shows in Apetit’s numbers. Q4 revenues in the food solutions segment grew 7 % vs. 1,7 % for the food retail market generally (in FY2017).

And if you look at the food solutions numbers, every new 1€ of revenues has created 0,45 € more EBITDA, i.e. 45 % incremental margins.

If the revenue continues to grow for the same speed for next year, with the same incremental EBITDA-margins the food solutions EBITDA will be 6,5 meur or almost double the current levels. With current depreciation the EBIT would 2,1 meur i.e. significantly positive vs. significant losses currently.

And this is trend that is going to continue for quite some time. The driving force behind the veggie/alternative protein trend is that x% of animal proteins will be replaced with vegetable proteins in the future, firstly because the healthy living trend and secondly because the world has to.

On global level, even small numbers are big growth opportunities for the so inclined.

And thus, the vegetable based food and vegetable based protein companies are “hot” assets currently in the M&A market.

Maple Leafs, biggest meat producer in Canada, bought Light Life (vegetable food/vegetable protein food) for 3,5x revenues. With the same valuation Apetit’s frozen food/vegetable food/vegetable protein food business would be woth 50*3,5=175 meur vs. 90 meur market cap.

Now, I don’t believe Apetit is worth that much, but tells you about the potential if Apetit gets in to the growth mode in the veggie segment (as the Q4 report shows it seems to have done).

Also Pinnacle foods, one of the leading food packaging companies in North America, bought Gardein. I don’t remember the multiples but the rationale was getting new own plant based protein technology, in addition to the leadership position in the plant based proteins category.

Also Bill Gates is investing in the plant based meat business, although they have higher ambitions as they want to develop process for producing meat, real meat, from plant based sources, not “meat alternative”.

More over, Apetit has announced that it has started a program to develop its own plant based protein from rapeseed.

Currently, all plant based proteins to Finland is imported from foreign countries, so if they are successful they could sell the raw material for others and build platform for own branded products.

Now, there is all kinds of taste issues that they have to come to make successful products plant based proteins, but my take is that the management is very much on the top of latest global food trends and will take the necessary steps to capitalize them.

Apetit has unique brand as it’s associated with veggie food already. They can now monetize it better as it has suddenly became very relevant due to the sustainability trend. They have significantly improved their marketing game on this front.

My point is that Apetit is sitting in middle of the mega trend and the management seems to be making the right moves to capitalize on them.

And it should be noted that the profitability has been weak due to significant increase in R&D (from 0,8 to 1,9 meur). Adjusted for the R&D expenses, which is clearly showing immediate results (7 % revenue increase), the profitability development has been quite good.

They have also started to focus on exports, for example some of the frozen food products are available now in Russia through partnership with Finnish food retail chain S-Ryhmä.

Although the short term result are disappointing, I’m VERY bullish on the longer term outlook.

And the other segments:

Grains: Well, this is cyclical business so the year-on-year results are pretty much random. There was bad year in Finnish agriculture so supply of grain was bad, both in terms of volume and quality, and the prices were bad too. Wouldn’t blame management on them. The strategy initiatives are moving on (the Baltics expansion, new services, working capital improvements).

Oilseed: The bad crop year also effected raw material supply for Oilseed which, I assume, had to be replaced by (more expensive) imports, explaining some of the bad development in the profitability. I haven’t made full analysis what’s happening in this business.

The biggest risks I see is the development of competitive forces in the hot Food Solutions segment, and long term raw material supply for Sucros and Oilseeds.

The grains is pretty much random, but I think the business will be around for next 100 years so I’m not giving much weight on the short term results.

So my current thesis is transforming to that Apetit is a growth/food technology stock in the hottest sector in retail and if the good sales performance in the food solutions continues, the stock will be re-rated considerably. Now this is evolving thesis and needs some more evidence, but if it gets more support, I’m ready.

The problem is that I might be looking the future with too rosy lenses, after having watched lot of investment banker decks about the future of veggie food trends…so be aware that my assessment is probably pretty biased.

And one more thing, Apetit has announced that it will be buying new businesses. It currently has say 15 meur cash for acquisitions and if coupled with leverage, say 30 meur. The hidden earnings power in the M&A firepower should be factored in when calculating current/future P/E-ratios.

LikeLike

[…] I have commented on the last comment of my original writeup, generally I’m very bullish on the vegetable food/health food trend which is one of the few […]

LikeLike