This post got a bit long so I decided to divide it to two parts. Part 2 can be found here.

Month or two ago a reader sent me a question about my recent purchase of Apetit, a Finnish food conglomerate, which was one of the first stocks I wrote about when starting the blog about two years ago.

Saw your recent tweet on buying Apetit – what changed in your opinion since this write-up where you passed? Will they actually divest any of the underperforming businesses? EBIT has continued to decline every year since 2011… Are management’s targets of 20m in EBITDA by 2018 realistic?

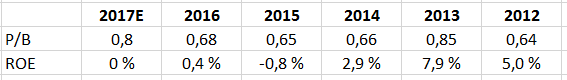

At the time of first the writeup Apetit was low P/B underperformer with many unprofitable businesses. The decision was not to invest because I didn’t see catalyst that would change the situation.

But now the situation has changed as Apetit has

1) New ROE focused management and strategy

2) Divested underperforming assets

3) Profitable and growing core

4) Problematic parts that seem well contained

5) Excess liquidity for acquisitions as result of the divestments,

leading to my purchase based on thesis that the current discount to book value is no longer warranted (P/B 0,8).

More over, Apetit could be worth significantly more than the book value if the management’s new vision will be materialized.

1. New ROE focused management and strategy

Apetit’s new CEO is from StoraEnso where he was one of the architects of their turnaround.

He’s a dry engineer, sets clear measurable goals, follows them and is seemingly a cost guy; he was managing StoraEnso’s declining printing and paper business, where the focus was on cost and constant restructuring.

Apetit’s new mission is to “create wellbeing from vegetables” and vision to be the “leader in vegetable-based food solutions”. The strategy is to capture the fresh, vegetable and organic food trend which are winning shelf space in retail stores.

Biggest change is that Apetit is no more just frozing and packaging peas and carrots, but developing new higher value added products (few examples later). Slide from last CMD deck pretty clearly shows the new direction:

New products in existing businesses (like juices and berries), expansion in fresh products, new processed products in grains and new food based services and digital solutions.

Strategy is to expand organically and through acquisitions in the fragmented market.

2. Divestment of underperforming assets

In addition to shifting focus to vegetables and product development one of the key messages has been that Apetit will only tolerate profitable businesses.

From segment reporting it can be seen that there is a lot of work to do in the Food Solutions and Seafood segments:

Just recently, the Company made announcement that the Seafood segment will be sold (for about book value, which is surprisingly good price given that the segment has never made a profit), so clearly the management is living up to their words on focusing on vegetables and profitable businesses.

After the Seafood business divestment the Company is left with

1. Unprofitable Food Solutions business

2. Profitable Grain Trading business

3. Profitable Oil Seed Products business

4. Cyclically profitable JV interest in sugar production business (not shown in the segment reporting)

That is, there would be only one problematic part in Apetit i.e. the Food Solutions segment. But let’s look at the profitable parts first.

3. The profitable and growing core

Frozen Food

The crux of my investment thesis is that the “problematic” Food Solutions segment is significantly better than it looks from the surface (-2,6 meur operating profit in 2016, biggest loser in the concern).

For the Food Solutions segment is actually many different businesses/subsidiaries; a Frozen Food business (Apetit Ruoka Oy), a Fresh Food business (from 2016 onwards in Apetit Ruoka Oy but before in Caternet Finland Oy), Service Sales business (before the divestment in the Seafood business through Apetit Kala Oy, but currently probably through Apetit Ruoka Oy) and some other supporting and real estate holding companies (Apetit Suomi Oy and Kiinteistö Oy Kivikonlaita):

And looking at the most important unit in the Food Solutions segment, the Frozen Food business, it seems to be the largest profits center and highest quality part of Apetit:

The business comprises of frozen vegetable products (mixes of carrots, peas, corn etc.) and frozen ready meals (soups, pizzas etc).

In 2015, the business had 4,5 meur operating profit with high margins and ROIC. In 2016 management said that revenue grew 5%, and if EBIT-margins were at the same 10% level as they were in Q1’16 (last known numbers) then EBIT in 2016 has been about 4,9 meur.

Reason behind the growth after many years of stagnation is the new product development strategy and the new product launches (for example the new vegetable based ice cream, vegetable based meat balls and vegetable based hamburgers).

As low beta branded consumer product business focused on booming vegetable sector it could be worth a high multiple (look at the international FMCG business multiples and you see what I mean), but I will go with more conservative valuation.

With standard 10xEBIT multiple enterprise value would be about 49 meur and if all of the Food Solution segment’s 0,9 meur concern costs are allocated for the Frozen Food business and capitalized with same multiple, about 40 meur.

Grain Trading

The grain trading segment buys and resells half of domestic grains in Finland and has 40% market share in exports, so it’s a major player in the Finnish food supply ecosystem.

Currently it distributes around 0,8 Mt of grains and targets about 1,0 Mt in 2018 by expanding business to Baltic and by utilizing its new export terminal in Finland.

Profitability varies with grain prices and volatility. Currently grain prices are historically low so 2016 profits are probably at low-end of the potential spectrum.

If the Baltic expansion succeeds, grain prices improve and future 14% ROIC target materializes earnings could be significantly higher in the future.

The growth prospects, important strategic position in Finnish food industry and with most assets being liquid grain inventories it would be hard to believe valuation below net asset value for the segment (26 meur).

Oilseed Products

Oilseed Products segment is Finland’s most significant producer of vegetable oils as the segment has the only large-scale vegetable oil production factory in Finland. The output is sold mainly to Finnish food industry (low margin) but also to consumers and for pets (high margin).

The business is nicely profitable and the revenues have been growing in recent years.

The segment will put more focus on higher value added consumer packaged products in the future, which management expects to have significant positive impact on the profitability (target EBIT 6%).

As with the Frozen Foods and Grain Trading, the Oil Seeds Product segment has excellent market position. It’s stable, growing and profitable, so it’s clearly worth at least the net asset value but probably significantly more. With standard 10x EBIT multiple the segment would be worth 27 meur.

Sucros

Sucros operates sugar factory in Porkkala and beet sugar factory in Säkylä and Apetit has 20% JV interest in it. Sucros is the only company producing sugar in Finland so it has very good market position domestically.

The business is more or less function of international sugar prices and has been consistently profitable, excluding 2015 when sugar prices were at historically low levels.

Apetit’s share of the Sucros profits have averaged 2,6 meur in last 10 years.

Apetit’s share of Sucros net profit (Source: Inderes):

In 2016-2017 prices have recovered so Inderes analysts are estimating improving profits for 2017-2018.

EU sugar price trend 2006-2017 (Source: EU sugar price dashboard):

Apetit’s share of current book value is about 22 meur.

Apetit’s share of Sucros equity (Source: Inderes):

In my first Apetit post in 2015 I wrote about Apetit’s existential threat. At the time, according to the Finnish agricultural research institute, sugar production in Finland was under threat because EU was abolishing sugar production quotas.

As of today, I have very little new to add to my original discussion except that the plant closure seems like more distant risk. There has been significant investment to production capacity and there is new contract with sugar beet farmers to secure raw material supply for few years.

The management has said that they see the 20% JV interest as “portfolio investment” and that they are currently watching where the European and World sugar market is going(@27:10). My interpretation is that it will be sold eventually as the relationship with the 80% owner Nordzucker has not been easy.

As the average net profit (>2 meur) implies good ROE for the current book value (~22 meur) so P/B=1 valuation seems appropriate.

Summary

So per the math and thinking just presented Apetit’s “profitable and growing core” is worth about 115 meur, which is significantly more than the current 86 meur market cap.

But before diving in to that, let’s look at the problematic parts in Part 2.

Disclosure: Long Apetit with 7% position

[…] ….continuing from Part 1. […]

LikeLike

[…] wrote investment thesis about Apetit about one year ago, which was based on sum-of-parts valuation and expected turnaround in troublesome Food Solutions […]

LikeLike

[…] years ago, I even jumped in as new management updated strategy and sold some bad assets. That ended badly, but now I’m […]

LikeLike