One of my favorite bloggers Alpha Vulture is latest hardcore value investor finding value in technology growth stocks, joining the ranks of Wexboy with Google and Warren Buffett with Apple.

His writeup of XPEL is short and simple, but opens his thinking in key decision factors determining why the stock is undervalued:

- High 37x trailing P/E and 400 % stock price increase this year, doesn’t matter

- Superior product, something to do with cars

- 50 % annualized revenue growth for six years

- High profitability for the whole period

- 80 % revenue growth in last half-year

- Assuming half of the annualized historical revenue growth for two years ahead and more or less historical profitability, after tax 2y forward P/E is 10x

Does it need to get more complicated than that? Reminds me of Alice Schroeder’s story on Buffett’s analysis on Mid-Continent Tab Card investment back in the days.

My typical hunting ground has been more on traditional value styles:

- Liquidations (Italian Real Estate Funds, Black Earth Farming)

- Special situations (Ferronordic convertible preferreds, Sirius Real Estate recapitalization)

- Complicated valuations (Elverket Vallentuna)

- GARPs (Installux, Kotipizza, Vente-Unique, Telia Lietuva, Olvi, Byggmax)

- Sum of parts valuations (CAFOM, Apetit, Ilkka, Rella Holding)

- Turnarounds (Martela, Catella, Rezidor, Tikkurila)

- Deep value (Argo Group, TxCom, Cofidur)

- Low P/B (Orava, Danske Andeelskasser Bank, Nordea)

Not all have been written here and some have been in the portfolio for a very short time as research positions, but you get the point, there are no growth stocks.

Recently, I have stumbled on Admicom few times. It’s a growth stock doing specialized ERP systems for SMEs in construction, installation and industrial sectors doing project business.

It’s not exactly cheap from the surface:

- Market cap 93 MEUR

- EV 84 MEUR

- Revenue 2018E 11 MEUR

- EBIT 2018E 3,6 MEUR

- EBIT-% 33%

- P/E 18 31x

- EV/EBIT18 23x

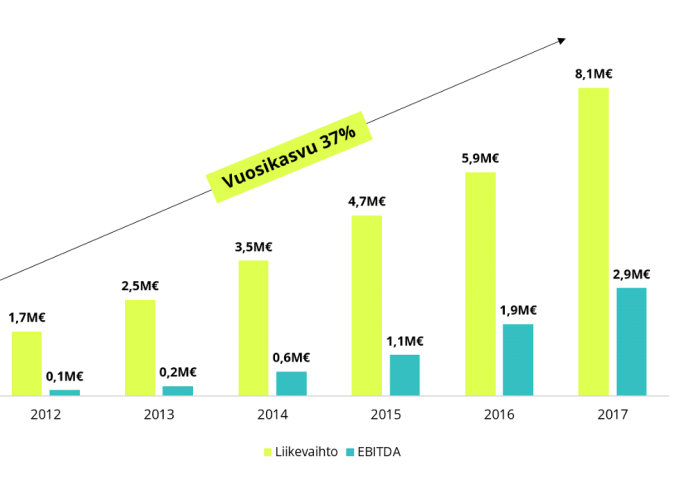

But it grows, 37 % 5y revenue CAGR, while making a profit (31 % EBIT in 2017):

It’s a SaaS business and the pitch is that everything is automated and it can save 1-3 administrative workers’ time in handling billing, salaries, book keeping and project bidding, and gives real time project and segment profitability information.

They claim that there is no competitor which would have integrated and automated everything related to managing project related SMEs in the construction, installation and industrial sectors.

Competitors’ have solutions for only specific parts of the process or have less automation.

Admicom’s main selling point is that automated, integrated solution is the best because there is no need for multiple systems and you can get rid of most of Excels.

On two occasions our customers at work have had Admicom’s systems. Unlike our other customers, we got timely, detailed, standardized profitability and progress reports from them.

The other customers who use self-made Excels combined to other systems, the information is either not timely, accurate or existing, or not as complete as with Admicom’s users.

Typically we would be speaking of segment or project profitability related data consistent with official accounts.

Important would be that all costs have been allocated to cost centers, tell how project portfolio progresses and give real time percentage of completion method accounts, which Admicom users have and the typical others don’t.

My perception is that with Admicom’s real time percentage of completion accounts the entrepreneurs are for first time in real time able to know their profitability and thus manage the companies better.

In essence, the small construction, installation and industrial project companies (say, 1-10 MEUR revenues) have through Admicom similar level information as much bigger companies with tailored enterprise level ERP solutions, just slightly lighter but almost as equally informative.

In Admicom’s target segment, my perception is, per half dozen customer interactions in my work (no wider data), that most companies don’t have integrated ERP systems because they have until recently been too expensive. Everybody struggles with Excels.

That’s the market which Admicom is targeting, under digitalized SMEs (1-15 MEUR revenue). They claim to have about 700 customers (IPO presentation Q&A session), growing 30 %+ annually. Customer churn is 2 %, so they seem to be sticky (and happy?).

There are about 10 000 companies in construction, installation and industrial sectors doing some kind of industrial manufacturing (typically metal shops doing contracting work) in 400 KEUR – 40 MEUR size category (per Statistics Finland), which is rough estimate of the total addressable market.

Thus, Admicom has about 7 % market share currently. It claims 20 % market share in HVAC installation segment, 10 % in construction and 1 % in industrial sector, where it just started.

There is clearly room to grow and historical 37 % revenue CAGR with 2 % churn implies that it’s realistic to assume that the product is good and that the growth can continue.

Inderes has made analysis and models 30 %+ growth continuing for many years with 30 %+ margins, i.e. same what Admicom has historically delivered.

Using the Alpha Vulture’s framework, the Inderes model implies 17,5x P/E20 and 11,8x EV/EBIT20.

The P/E is not as attractive as with Alpha Vulture’s (conservative) model for XPEL, but adjusted for cash (earmarked for acquisitions supposedly brinning more earnings in the future) the EV/EBIT20 seems pretty low for a 30 % grower.

SaaS is a interesting business model because once the sales people have brought in the new customer, it doesn’ need to be replaced.

Remember, the earlier mentioned 2 % churn implies 50 years average customer lifetime so the proverb “if you are not selling and growing, you are dying” doesn’t apply here.

If the market is saturated, then in theory you wouldn’t need sales personnel as the operating and customer teams would keep the existing customers happy.

(In reality when markets approach saturity, companies try to expand to new markets, new products or do some dumb shit that the existing organization wouldn’t needed to be scaled down and move to no-growth mode).

Admicom’s personnel expenses were 3,7 MEUR in 2017. There are about 20 sales people and if they average about 60 KEUR a year, the new customer acquisition cost per annum is about 1,2 MEUR, leaving 2,5 MEUR of the personnel for support, customer service, accountig service, administration and R&D.

There are about 1,1 MEUR other operating expenses which are more or less fixed and related to premises and other expenses needed to run the business.

Without the sales personnel Admicoms no-growth total operating expenditures are about thus about 3,6 MEUR.

Admicom had about 700 customers in end of 2017 and 8,1 MEUR revenues. With assumed 30 % growth in number of customers from beginning of the year, the implied average customers for 2017 was about 630 and thus run rate revenue per customer about about 13 000 EUR.

With the 3,6 MEUR no-growth OPEX, some minor COGS and 9,1 MEUR run rate revenue from the existing 700 customers (@ the 13 KEUR annual rate), Admicom’s no-growth EBITDA level is about 4,9 MEUR with 54 % margins:

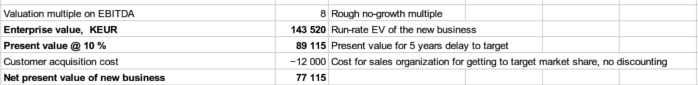

With 8xEBITDA multiple (to assume for some minimal depreciation and taxes) the no-growth enterprise value would be about 40 MEUR.

So with the current 84 MEUR enterprise value, you are paying about 44 MEUR of the future growth.

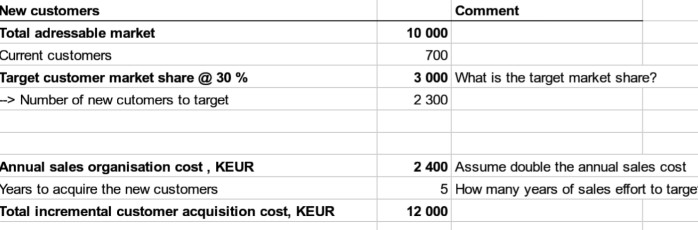

Like I said, the total adressable market is about 10 000 customers, and depending of the segment, Admicom’s market share is 1-20 %. The HVAC segment’s 20 % market share, the seemingly untapped market and the strong growth as a reference point, 30 % market share doesn’t sound totally unreasonable.

The 30 % market share implies 3000 customers which implies 2300 new customers. Admicom has hired new sales people to tap the market opportunity faster.

Assuming double the current sales expenditure and five years to acquire the new customers (I think that if Admicom’s technology is really superior, it doesn’t take 10 years to adopt it, so five years is my best guess), the total customer acquisition cost is about 12 MEUR

And after the new 2300 new customers have been acquired the question really is how much will the service and operating expenses grow? If the systems scale, not so much, but if there is heavy service component or whatever, then they could grow in proportion to the increase of customers.

Per the previous calculations, no-growth EBITDA margin for the 700 customers was 54 %.

Assuming small economies of scale so that the EBITDA margin is 60 %, then with same revenue per customer the 2300 new customers will bring 17,9 incremental EBITDA on run-rate basis:

Assuming the same 8x EBITDA no-growth multiple for the new business, present valued for the assumed five year delay to acquire the new business and the undiscounted 12 MEUR customer acquisition cost, the new business is worth 77 MEUR.

And adding the 40 MEUR current no-growth value, the 77 MEUR new business value and the 10 MEUR cash, equity value is 127 MEUR or 26 EUR per share. That’s 38 % upside relative to 19 EUR per share market price:

So the first reaction is that it could work. Main assumptions are the target market share and incremental EBITDA margin of the new business.

There would be 50 % upside if the incremental EBITDA margin would 70 % instead of the assumed 60 %.

There would be 80 % upside if the target market share is 40 % instead of the assumed 30 %.

Assuming the target market share is 20 %, the upside would be -5 %.

All of the scenarios seem plausible to me. The reasonable downside scenario seems -5 % and the reasonable upside scenario 80 %, so the very roughly calculated probability distribution looks actually quite attractive.

What is lacking though is conviction on this pretty shaky back of the envelope analysis, but I think it was useful.

Is the product any good, what are the competing products, are the customers really using Excels currently and are they ready to change en masse within next few years?

I leave it at that this time, for with this analysis it doesn’t seem better than the Alpha Vulture’s XPEL case, which has faster growth but about the same P/E and bigger addressable market.

Disclosure: No position in Admicom and no immediate plan of purchasing with these prices