Ilkka, a regional news paper and big owner of publicly listed multimedia and marketplace business, Alma, sold 13,5 m. shares of the Alma stake @ 7,4 EUR last Friday.

Before the transaction, Alma’s share price was 6,2 EUR, so the transaction was conducted at nice premium.

That was a good thing, but pretty much the only good thing in this transaction, as I later explain.

My original thesis with Ilkka was that it was trading at significant holding company discount/negative EV, if the big stake in Alma was valued @ market value.

The stock price reacted quickly to the transaction and went up 15 %+:

From my original writeup in March, thanks to the transaction, Ilkka’s stock outperformed the Alma’s shares significantly.

Buying Alma through Ilkka, with this short comparison period, seems to have been better decision than buying Alma directly.

Yet, despite the increased stock price, the core business is still trading at negative EV:

After the transaction, only thing that seem to have changed since my original writeup is the net debt composition; from mostly Alma shares (169MEUR) to lot of Alma shares (61 MEUR) and lot of cash (100+ MEUR).

Lot of cash instead of lot of Alma’s stock means that Ilkka’s valuation has less Alma risk.

Lot of cash also means that the Alma risk will change to some other business risk. For Ilkka announced that the 100 MEUR proceeds will be used to strategic acquisitions (and debt repayment).

Ilkka’s stated mission is to improve the regional economy it’s operating in, so I expect that the 100 MEUR, or some portion thereof, will be used to regionally related acquisitions.

This is bad.

Firstly, the regional area they are operating in might not be home for many or any good businesses, leaving opportunity for only bad acquisitions (at least relative to owning the growing and well managed publicly listed Alma).

Secondly, Ilkka starts to resemble the many regional telecom cooperatives in Finland that have sold their phone line assets and transformed themselves into ”investment companies”.

History shows that the cooperative based investment companies don’t increase shareholder value, power is more or less among local strong men and the investments are typically somehow related to local/regional economies.

They resemble more like political organizations, not shareholder value driven investment organizations.

Ilkka’s governance structure is similar to the regional phone cooperatives. Annual meeting selects advisory board which selects the board.

With the 21 member rotating advisory board consisting of local farmers and other non-digital-media related people selected by I-don’t-know-what-competence-requirements, it’s almost impossible for activist investor to start control the company and rationalize the capital allocation decisions.

If I would have been in charge, I would have sold the bad regional news paper business and bought more of the good Alma instead (or liquidated the whole company to unlock the holding company discount).

They decided to do pretty much the opposite. I’m afraid that the 100 MEUR will be pissed away to bad (regional) acquisitions so that the status-quo of current power men will not be endangered.

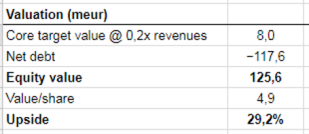

Valuation

The news paper business is worth about 8 MEUR if it’s valued @ 0,2x revenues.

Currently the profits are improving as the restructuring measures are coming through.

My estimate of the “run rate” profits are about 1,4 MEUR, but it could be higher if the printing business continues to grow. So I think the 8 MEUR is fair.

Adding the previously presented 118 MEUR broadly defined net debt, the equity value is about 126 MEUR, or 4,9 EUR/share, which implies 29 % upside:

I will keep my shares despite the lower upside than in my original writeup (57-68 %) and the problems in governance.

Now Ilkka’s market cap is almost totally covered by the cash proceeds from the transaction, net of debt, so the Alma share price risk in Ilkka has reduced significantly. Basically by buying Ilkka, you are mostly buying cash.

More over, there is some upside governance risk, that the 100 MEUR cash will actually translate into lot of earnings through the planned future acquisitions.

Say, with 100 MEUR purchase price you could get 10 MEUR more EBIT. The regional/local businesses could come even cheaper than that.

By clipping and gluing different scenarios for purchases prices, Ilkka’s current stock price could imply very low “after acquisition” EV/EBIT-multiple.

If the 100 MEUR cash is translated into wholly owned businesses earning good money, maybe the stock price goes up when “market” sees the true earnings, not “look through” earnings of the minority owned publicly listed Alma.

Conclusion

Overall, I think Ilkka is throwing good money after bad. Most of the value in Ilkka was in the controlling stake in Alma, not in the core Ilkka’s regional news paper business.

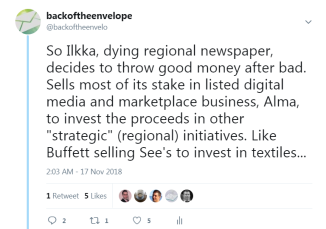

Now they have decided to sell the Alma stake to invest in the regional business. This is like Buffett selling See’s Candies/Coca-Cola shares to invest more into the dying textile mill business, as I tweeted earlier:

The long-term winners in this transactions seems to be Alma’s existing shareholders and Otava, the buyer of the Ilkka’s stake.

For Alma has the largest property classifieds and the second largest car classifieds websites in Finland (among other assets), and Otava has the largest car classifieds site (among other assets).

I wouldn’t be surprised if Alma and Otava will be merged in the future, which would make heck of a classifieds business through hidden pricing power if they were cooperating entity.

Classified businesses are basically network effect businesses and when someone gets dominating positions, they are never lost and you can increase prices. Thus combining the two would create significant value (dominating comps valued 20-30x EBITDA currently).

The Alma/Otava combination would have monopoly in Finnish economic news assets, dominating property and car classifieds assets, good position in jobs classifieds and duopoly position in yellow press digital business (stable habit-forming domestic gossip websites with original content monetized through display ads).

This merger could have been facilitated by Ilkka staying as big owner of Alma, but now Ilkka basically gave the keys for Otava and Alma’s other key shareholders.

Real icing on the cake would however be if the potential Alma/Otava combination would further be merged with Sanoma, the largest media company in Finland.

Sanoma has the second largest property classifieds business and the biggest jobs classifieds business in Finland, the other part of the Finnish duopoly yellow press digital business, and dominating general news brand in Finland (comparable to NYT).

The Alma/Otava/Sanoma combination would then basically dominate all of the biggest digital classified verticals, yellow press, economic news and general news assets in Finland, which in small language region like Finland could be competitive even against Facebook and Google.

The combination would also own lot of non-digital assets (TV, radio, news papers etc.), but they could be spun-off to other assets or nurtured to death.

Just to understand what dominating classifieds and other digital asset means, look at the stock priced Norweigian Schibsted:

Schibsted focused on dominating classifieds and digital business earlier on and has beaten the Finnish media counterparts hands-on. I think by combining Alma, Sanoma and Otava, something similar could be done in Finland. Cooperation over competition.

Given that the advertising business is increasingly global, not local, I could see the competitive authorities accept the transactions in the future.

That was the long-term thesis I was sort of building for Ilkka, long-term consolidation case of the top Finnish media companies and building Finnish “Schibsted”, because it was the largest shareholder in Alma and thus key player in facilitating the deals.

But after selling majority of the Alma stake, Ilkka won’t be participating in that anymore (they surely have some better ideas in their regional playground).

So I will continue to hold my Ilkka shares for a while but my longer term consolidation media bet, if any, would have to be facilitated through Alma and Sanoma.